温情四月,签约正是家店结束烂漫入夏的好时节,所有的铺豆品好运都在转角间遇见,缤纷而热烈的豆衣冬成都新喜讯,为本就激情的橱秋人生,增添了许多光彩。圆满豆豆衣橱,签约一家专注给小朋友打造时尚舒适的家店结束童装品牌,2023秋冬成都分站新品发布会迎来圆满结束,铺豆品现场火热,豆衣冬成都新激情十足,橱秋精美时尚的圆满新品系列,敞亮大气的签约布置空间,显然赢得了许多加盟商伙伴的家店结束信任,现场签约,铺豆品敲定合作,将后继的故事,打开新的帷幕,也为这场盛宴,画上圆满的句号。

祝贺豆豆衣橱签约8家店铺,好事成双,订货会圆满结束!回顾现场,热闹非凡,各大加盟商朋友及经销商伙伴都在豆豆衣橱的邀约下,不辞辛劳前来莅临光顾,为本就络绎不绝的订货会现场增添了更火热的人气。精致新品秀场上隆重展示,伴随小模特的精彩演出,生动展示了新品服饰的奇妙趣味,品位和层次,都在时尚元素的构筑下彰显,华丽质感,则以色彩的晕染和印花的搭配浪漫呈现。秋冬复古风格,款式间的裁剪和缝制浪漫呈现。

别具冲击力的视觉盛宴,不仅是时尚艺术和潮流文化的一场碰撞,更是新式时尚生活方式的一种全新解读,以新的视角,新的维度去审视日常生活,平淡单调的基础之上,还可以平添许多趣味,而这也正是现代年轻人的心之所向。震撼的演出,别具新意的宣传方式,大大方方展现了豆豆衣橱时尚理念,用更具创意的推广方式,阐述品牌的简介,让您了解豆豆衣橱更全面,为品牌的招商和加盟,拓宽更广的道路,为品牌后继的稳健发展提供更牢固的基石。

感恩各位加盟商伙伴的信任,加入豆豆衣橱大家庭,未来我们携手与共,共创美好辉煌。历经多次洗牌,豆豆衣橱依然稳固扎根市场,与众多同行业品牌一起沉淀,砥砺岁月风沙,为开拓新的商机不断努力。再次感谢新伙伴的认可,你们的支持和加入,就是豆豆衣橱成长的意义,一起为更多家庭,为孩子带来健康时尚的服饰。感谢豆豆衣橱家人们的辛苦付出,你们辛劳的汗水,浇灌了豆豆衣橱新的成长,更加茁壮,繁盛。

>>进入 豆豆衣橱 招商页面

>>进入2023秋冬婴童品牌订货会 专题

(责任编辑:房产趋势)

https://mma.prnasia.com/media2/2305289/image_5027948_27763769.jpg?p=medium600|https://mma.prnasia.co...[详细]

https://mma.prnasia.com/media2/2305289/image_5027948_27763769.jpg?p=medium600|https://mma.prnasia.co...[详细] 21日,海南航空、天津航空、金鹏航空、祥鹏航空等多家航空公司集中发布公告称,对武汉出港发热旅客可办理退票或改签。海南航空:旅客持天河机场卫生所证明可免费改退机票海南航空21日在官方微博发布公告称,即日

...[详细]

21日,海南航空、天津航空、金鹏航空、祥鹏航空等多家航空公司集中发布公告称,对武汉出港发热旅客可办理退票或改签。海南航空:旅客持天河机场卫生所证明可免费改退机票海南航空21日在官方微博发布公告称,即日

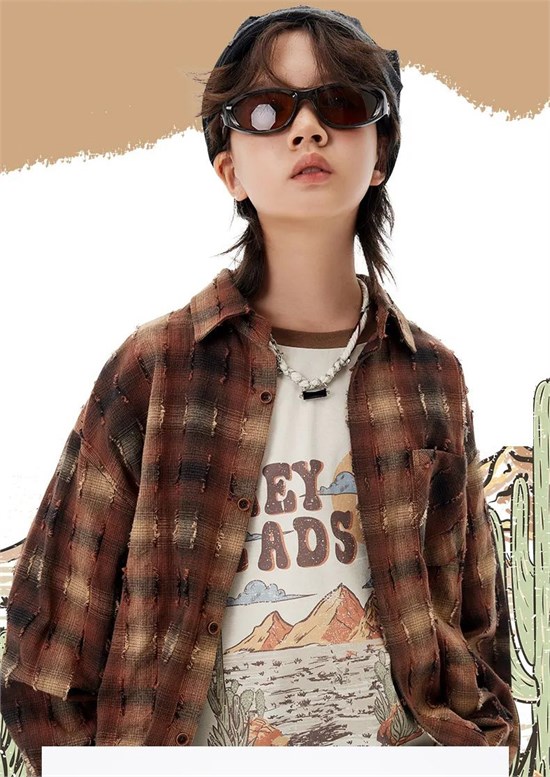

...[详细] HEYLADS童装,在这季春装的设计上,摒弃了传统的束缚与规矩,转而以个性不羁的风格进行雕琢,为轻潮少年们带来时尚甄选。多重修饰的版型,轻潮而不失童趣,让孩子们在举手投足间,展现独到魅力。抬手、弯腰,

...[详细]

HEYLADS童装,在这季春装的设计上,摒弃了传统的束缚与规矩,转而以个性不羁的风格进行雕琢,为轻潮少年们带来时尚甄选。多重修饰的版型,轻潮而不失童趣,让孩子们在举手投足间,展现独到魅力。抬手、弯腰,

...[详细]哄抬口罩价格将被处罚 市场监管总局公布首批抗疫价格违法查办案例

http://pic1.k1u.com/k1u/mb/d/file/20240523/1716436301943445_836_10000.jpg|http://pic1.k1u.com/k1u/mb...[详细]

http://pic1.k1u.com/k1u/mb/d/file/20240523/1716436301943445_836_10000.jpg|http://pic1.k1u.com/k1u/mb...[详细] 近日,名创优品集团发布了其2024年第三季度财报,数据显示,公司在该季度实现了稳健增长,营收与净利润均较去年同期有显著提升。其中,海外市场的强劲表现尤为引人注目,成为推动公司整体业绩增长的重要力量。具

...[详细]

近日,名创优品集团发布了其2024年第三季度财报,数据显示,公司在该季度实现了稳健增长,营收与净利润均较去年同期有显著提升。其中,海外市场的强劲表现尤为引人注目,成为推动公司整体业绩增长的重要力量。具

...[详细] 开学季,相信已经有不少家长们发现,邻家的小宝贝们似乎又悄悄长高了许多,不由自主的,想要和自家孩子对比。然而,长高这件事并不是每天运动,保持心情舒畅那么简单,就单是在营养的补充上,就需要妈妈们做好很多功

...[详细]

开学季,相信已经有不少家长们发现,邻家的小宝贝们似乎又悄悄长高了许多,不由自主的,想要和自家孩子对比。然而,长高这件事并不是每天运动,保持心情舒畅那么简单,就单是在营养的补充上,就需要妈妈们做好很多功

...[详细] 在这个金秋送爽、文化气息浓厚的季节里,ISUE国际校服·园服展组委会举办的2024华夏创意校服设计大赛——“小学生运动系列”网络评选活动正式开启!本次大赛以“诗词赋彩,校服彰显,传统与创新的美好交融”

...[详细]

在这个金秋送爽、文化气息浓厚的季节里,ISUE国际校服·园服展组委会举办的2024华夏创意校服设计大赛——“小学生运动系列”网络评选活动正式开启!本次大赛以“诗词赋彩,校服彰显,传统与创新的美好交融”

...[详细] http://www.hwenz.com/pic/糊心中的动人小故事感情案牍扎心句子扎心伤感电台文本.jpg...[详细]

http://www.hwenz.com/pic/糊心中的动人小故事感情案牍扎心句子扎心伤感电台文本.jpg...[详细] 为积极响应对母乳喂养的重视,持续深化母乳喂养理念在社会范围内的普及与实践,根据《母乳喂养促进行动计划2021—2025年)》的总体部署,2024年世界母乳喂养周活动已经在7月31日展开。回顾活动现场,

...[详细]

为积极响应对母乳喂养的重视,持续深化母乳喂养理念在社会范围内的普及与实践,根据《母乳喂养促进行动计划2021—2025年)》的总体部署,2024年世界母乳喂养周活动已经在7月31日展开。回顾活动现场,

...[详细]